Do you enjoy flexibility, empowerment and fulfilment in your career?

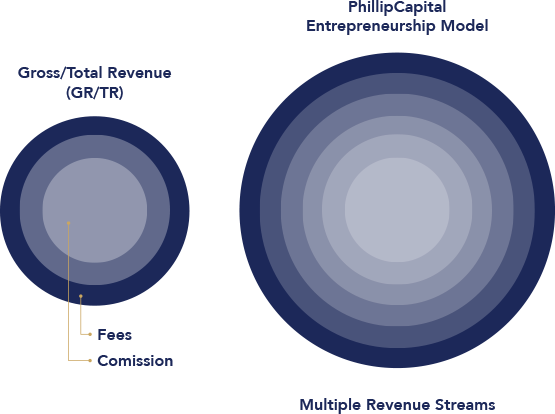

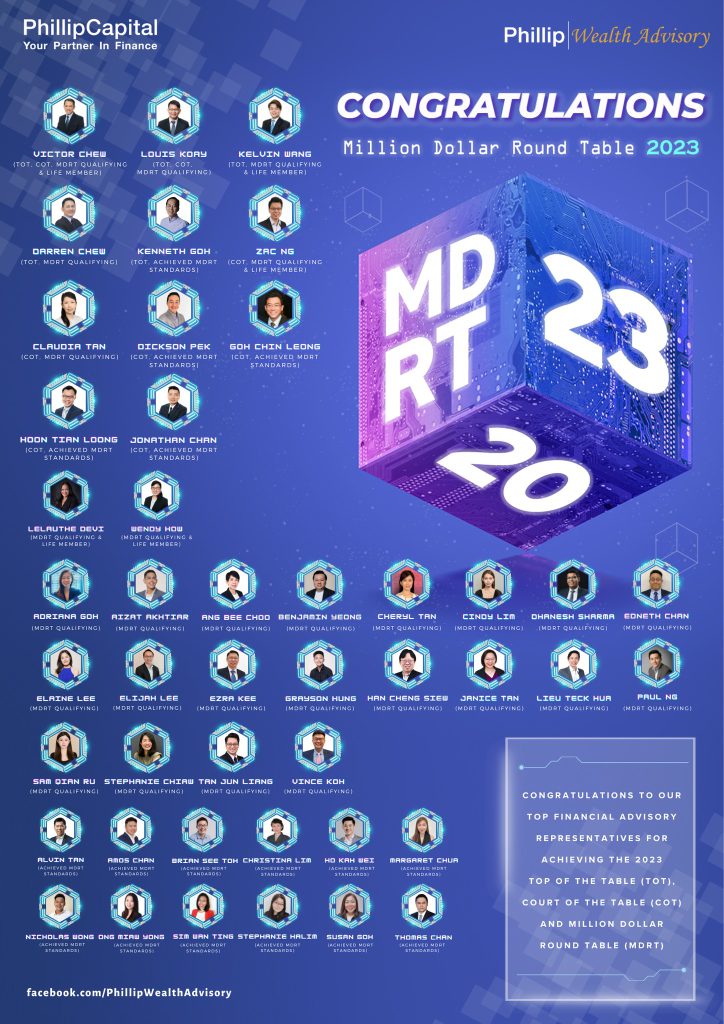

A career at PhillipCapital as a Financial Advisory Consultant, Trading Representative and Portfolio Managers can be challenging yet fulfilling.

As no client situation is the same, you will become nimble and more innovative as you think out of the box to help them find solutions for their financial needs.

Furthermore, you’ll find fulfilment as you share your knowledge and expertise with your clients and help them improve their financial literacy to secure a brighter future for themselves and their loved ones.

Think you have what it takes? Reach out to us at entrepreneur@phillip.com.sg and join us!